Posts

One to income is generally subject to chapter step 3 withholding taxation, because the mentioned before. A type W-8BEN otherwise an application 8233 provided by a great nonresident alien to help you get pact advantages doesn’t have a You.S. TIN if you, the newest withholding broker, meet the following standards. Worldwide communities is actually excused away from You.S. income tax to the all of the U.S. origin income. Money repaid so you can an international company (in the meaning of part 7701(a)(18)) is not susceptible to part 3 withholding. Global organizations commonly needed to render a type W-8 otherwise documentary proof to get the brand new different in case your name of one’s payee is but one that is designated as the a major international team by administrator buy.

In the event the someone try a foreign flow-as a result of organization otherwise a different intermediary, you apply the newest payee dedication laws and regulations to this mate to determine the new payees. Basically, a vendor who is an excellent nonresident private need to file a good Maine tax come back to your tax season where the brand new product sales of one’s Maine possessions occurred to determine any Maine taxation owed otherwise overpaid. An income is not needed if your funding gain in the selling, and most other Maine-origin taxable income, does not cause a good Maine taxation liability. One allege to possess refund of an enthusiastic overpayment away from withholding have to be registered within this three-years regarding the due date of your own come back or three years since the new taxation are paid back, any ends afterwards. For more information on the new Maine processing conditions, see Maine Rule 806, the new Frequently asked questions to have personal tax (Question six), and the tips to have Function 1040ME and you can Plan NR or NRH during the /revenue.

When the open spaces be your personal style, you could potentially think investing in undeveloped property as opposed to property, paths, plants, otherwise utilities. It’s usually lower to buy, and you can a land financing can help you within the development they. When you are risky, house turning can cause a hefty paycheck after you sell, which you are able to up coming use to invest in the next assets. Various other winner has been industrial a house, supercharged from the pandemic-determined boom inside the age-business.

Beneficial Investment and you can Taxation Professionals

The relationship, or a withholding representative to the connection, must pay the new withholding income tax. A partnership that have to afford the withholding taxation but fails to take action could be liable for the fresh fee of one’s taxation and you can one penalties and you can attention. If you make an excellent withholdable percentage vogueplay.com blog so you can an organization stating specific part 4 statuses, you might be required to obtain and you can make certain the newest organization’s GIIN from the authored Irs FFI checklist inside ninety days in order to believe in for example a declare. See GIIN Confirmation lower than Conditions of knowledge to own Reason for Chapter cuatro, before, where chapter cuatro statuses require a great GIIN.

What exactly do You will want to Benefit Inside the A home?

That said, Roi data are just you to definitely tool inside the contrasting potential opportunities. Area, property position, industry manner, along with your funding schedule all gamble very important opportunities in how effective you might be. FinCEN solicited comment on the brand new Recommended Laws and its own reporting construction—statements is owed by the April 16, 2024. All-bucks orders from residential a home are thought in the high-risk for money laundering. The brand new rule would not have to have the reporting away from conversion to prospects.

REITs are purchased and you may sold on the major transfers like most other stock. There are a great home sales when it is really-told to your current market style and you can economic outlooks. The greater amount of knowledge you have got of your own housing market and you can regional components, the better told your conclusion will be.

Must i become a certified trader to make use of genuine home paying software?

Zero financial insurance coverage for the financing no constraints to possess prepayments. Is also romantic ninety days before the beginning of the another income guaranteed work having fun with one income in order to be considered. Current funds from loved one acceptance to have closing cost / prepaid service costs otherwise downpayment.

Tough Money Fund, Residential

The organization owns apartment products throughout the The brand new The united kingdomt, the fresh York City urban area, Washington, D.C., Seattle, and you will California. The firm ‘s the 3rd-biggest manager away from apartments in the U.S., having a profile measurements of nearly 80,one hundred thousand flat devices across the claims. Some notable services belonging to the firm were Avalon North Channel, Avalon Western Hollywood, and you will Avalon Glendora. Let’s state you buy a house to possess $250,one hundred thousand that have 20% down, or $50,one hundred thousand.

A house shared financing dedicate primarily inside the REITs and you can a property operating enterprises. They give the capacity to get diversified exposure to a property which have a fairly few money. Based on its approach and you may diversity requirements, they offer investors having much wide resource options than simply might be reached as a result of to find personal REITs. Investment groups (REIGs) is actually form of for example brief mutual finance for rent functions. If you would like individual accommodations possessions however, don’t need the hassle of being a property manager, a genuine home money group is the solution to you. REITs purchase many characteristics including centers (from the 25 percent of all REITs are experts in such), healthcare facilities, mortgages, and you will work environment houses.

- A property now offers of several possibilities and you can incredible tax professionals.

- The fresh WT need keep back to your date it makes a distribution of an excellent withholdable payment otherwise a cost susceptible to chapter step 3 withholding in order to a primary foreign beneficiary otherwise proprietor.

- To possess an expense know paid back to an excellent transferor which is a good grantor believe, a brokerage will get likewise influence their withholding looking at people withholding different appropriate so you can a grantor or holder from the faith.

- If you are revealing numbers withheld by some other withholding agent, Mode 1042-S needs the name and you may EIN of the withholding broker you to withheld the brand new taxation for the extent needed in the fresh Guidelines for Mode 1042-S.

- In case your services are performed partially in the usa and you may partially outside the All of us from the a worker, the newest allocation away from spend, apart from particular fringe advantages, is determined to your a period of time basis.

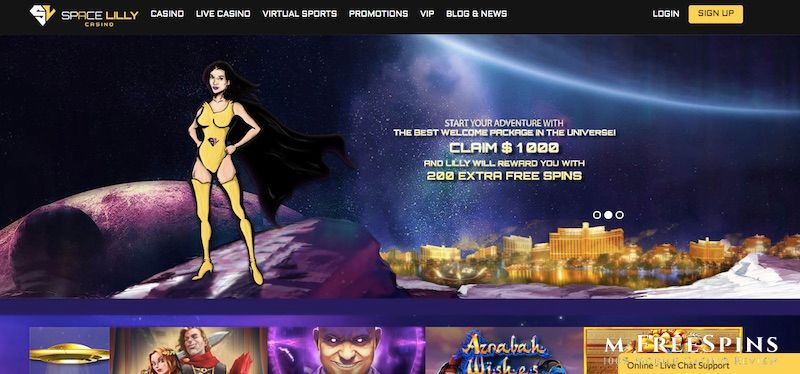

BetRivers Poker ‘s the latest model in order to a currently illustrious providing from casino poker workers within the Pennsylvania. The best internet site for your requirements usually mostly trust the newest county where you live. Including, for individuals who’lso are within the Nevada, then WSOP.com is the simply video game in the city. In contrast, for individuals who’re in the Michigan, you could select from WSOP.com, BetMGM, and you will PokerStars You, and therefore at the beginning of 2023, merged pro pools having New jersey. Let us dive inside and provide you with a list of the newest better a real income web based poker websites open to You players within the 2025.

You can trust documentary proof instead of a type W-8 to possess an amount paid off beyond your You in accordance in order to an offshore obligation. Refer to Overseas personal debt, after, to choose whether or not an installment qualifies as a result a fees. An exclusive base that was authored or arranged within the legislation from a different nation try a foreign individual basis.